-

Everything about How Much Car Insurance Do I Need? – Ramseysolutions.com

First of all, if you're purchasing liability insurance coverage, that insurance coverage is based around third-party insurance coverages the damages you can do to others. Furthermore, more recent cars have much more safety and security functions that could avoid or lessen mishap damage. In this situation, a more recent automobile may be more affordable to guarantee – cheaper car insurance. If you're buying complete insurance coverage automobile insurance for a lorry, the plan may be less costly on a made use of auto based upon the value of the car.

Loading Something is loading., or the cost you'll pay for protection, is just one of them.

Insurer consider many different elements, including the state and area where you live as well as your gender, age, driving background, as well as the level of insurance coverage you wish to have. cheap insurance. Insider assembled information from market regulators, individual money magazines, as well as comparison sites to identify which factors influenced auto insurance prices as well as what the typical driver can expect to pay (insure).

Bear in mind that there have been a number of significant adjustments to auto insurance prices throughout the coronavirus pandemic. Some vehicle insurance providers provide discounts as Americans drive much less and are assisting individuals affected by the infection hold off repayments. Average auto insurance policy expense by state, Every state deals with car insurance policy differently. States regulate their laws and policies regarding auto insurance coverage, consisting of just how much insurance coverage is required, just how much insurance is liable for covering, as well as what elements insurance provider can utilize to determine rates.

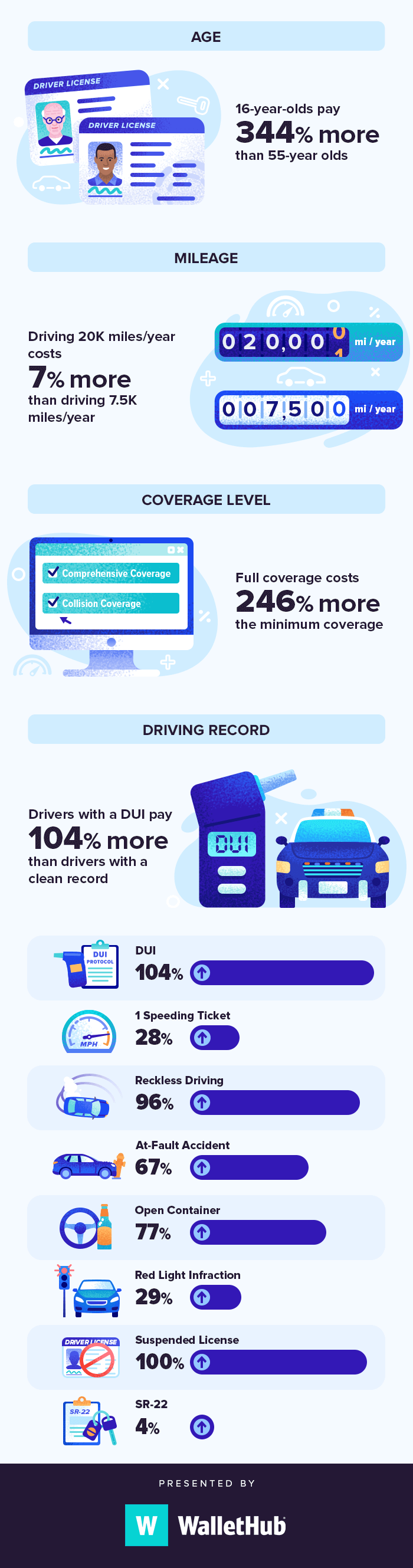

The variety of years you've been driving will likewise influence the price you'll pay for coverage. Car insurance policy costs have a tendency to drop with age. That makes guaranteeing a teen driver extremely expensive. However, it's also important to bear in mind that it will certainly vary from one person to another, no matter of your age based upon other elements like your driving history.

auto car insurance prices affordable car insurance

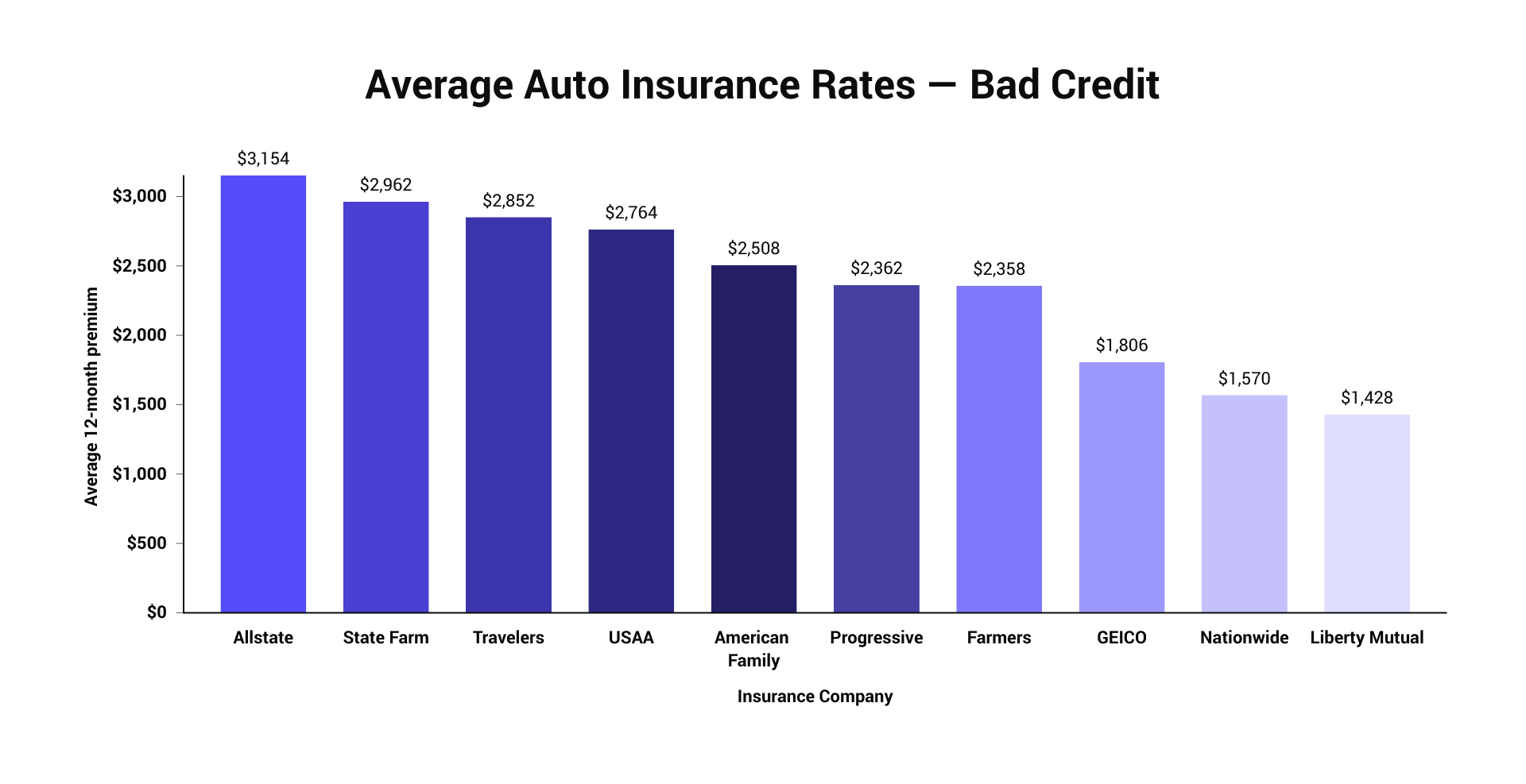

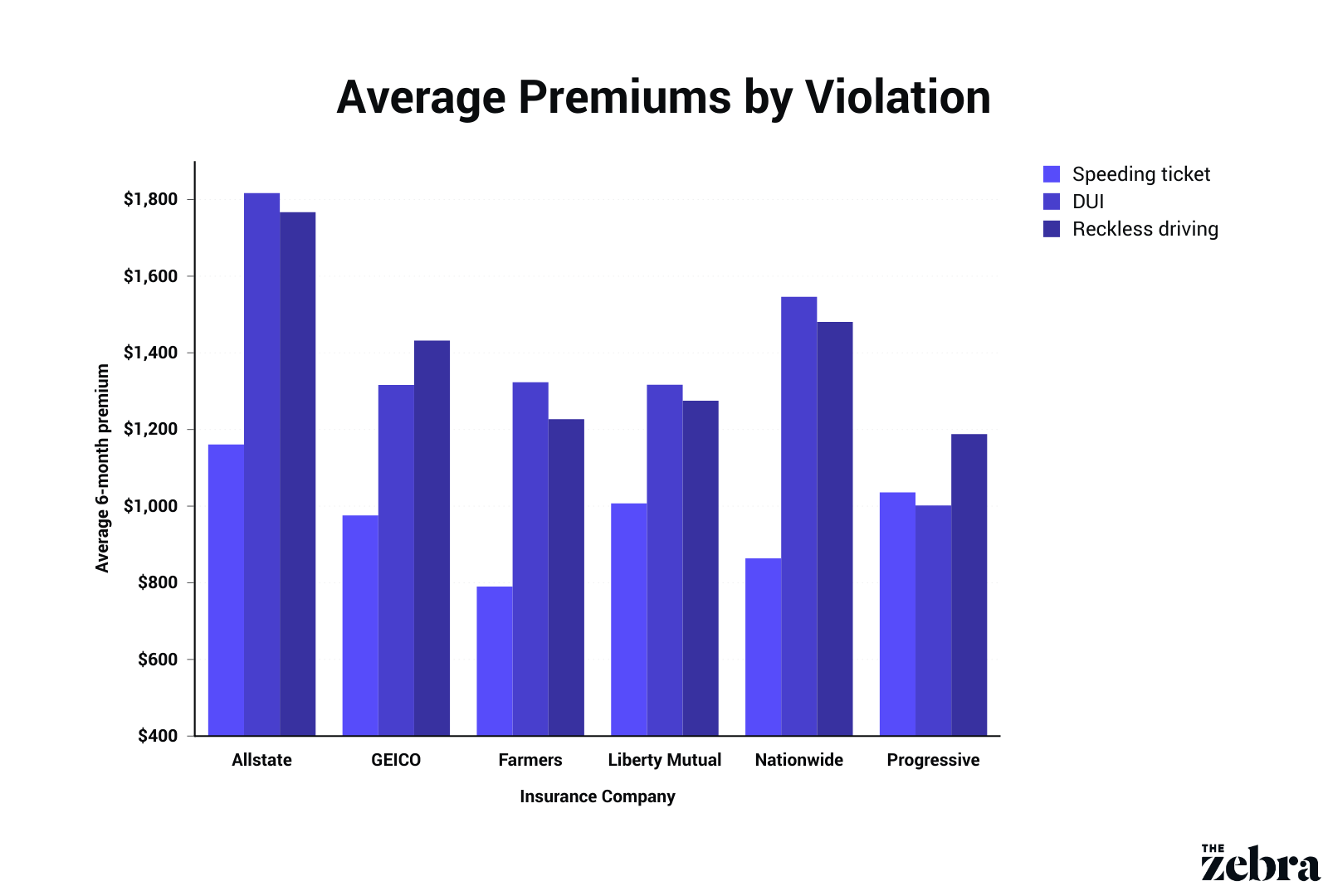

auto car insurance prices affordable car insuranceWhen you're married, auto insurance costs extra. After an accident, premiums leap 30%, according to and also Insure. com coverage, based upon information from Quadrant Info Provider. With a DUI on your document, insurance coverage will certainly cost 63% even more, according to Insurance coverage – insure. com and also Insure. com reporting (cheapest car). Consumer Reports assembled price pricing details from vehicle insurance firms in every state, and also discovered that credit rating ratings was just one of the greatest factors in premium Take a look at the site here costs.

What Does Auto Loan Calculator Mean?

cheap car perks auto insurance cheap car

cheap car perks auto insurance cheap car3 states (California, Hawaii, and also Massachussetts) do not enable debt ratings to be factored right into vehicle insurance prices. Auto insurance policy is less expensive in postal code that are much more rural, as well as the same is true at the state degree. Guarantee. com data shows that Iowa, Idaho, Wisconsin, and Maine have the most affordable vehicle insurance policy of all states, which's because they're extra rural states.

The much more expensive the automobile would be to change, the much more it will certainly set you back to insure. If you've had a void in coverage, it might raise your costs. Cars and truck insurance coverage has great deals of variables that enter into its pricing. And, it's altered over time. Data from the National Organization of Insurance coverage Commissioners shows just just how much auto insurance premiums have enhanced in time – vans.

insurance vehicle insurance cheap car insurance low-cost auto insurance

insurance vehicle insurance cheap car insurance low-cost auto insurance/auto-and-car-insurance-policy-with-keys-1048031806-6dbe3526b6d84e14aa23d07fbe11c40e.jpg) affordable vehicle insurance car vehicle insurance

affordable vehicle insurance car vehicle insuranceEach insurance firm looks at all of these aspects as well as prices your insurance coverage in a different way as a result. cheapest. Get quotes from several different vehicle insurance coverage firms and also compare them to make certain you're getting the finest deal for you.

Consider them also if your loan provider does not, or if you really did not fund your automobile purchase. Crash as well as extensive supply a lot of protection, as well as without them you and your wallet could be in for a major shock if an accident or a few other occasion damages or damages your new automobile (cheapest).

Choose the insurance company that is best for you, your new car and also your overall scenario. Buy your new cars and truck. Send the insurance company any kind of missing information, such as your new car's VIN, to settle the policy purchase. insurance companies.

Drive your new and also completely guaranteed auto off the great deal (credit score). Just how much is insurance policy for a new automobile? Automobile insurance policy for brand-new automobiles costs regarding $24 per month a lot more than car insurance coverage for old autos, based on our study. That's a difference of $291 per year – low cost. Automobile insurance coverage prices for brand-new cars vs.

What Does How Much Is Insurance For A New Car? – Car And Driver Do?

cheaper auto insurance cheap car credit vehicle insurance

Your prices might vary. insurance company. To condense this data:. Just how much your insurance rates rise with a new car relies on where you obtain or got your protection. There are several reasons new as well as newer cars and trucks tend to be more costly to guarantee than older autos: New autos generally need detailed as well as accident insurance coverages, along with obligation protection.

Replacement components for brand-new vehicles commonly set you back more than substitute parts for old cars. Does my current insurance cover a brand-new cars and truck? If you currently have an automobile that's guaranteed, its plan might cover your new vehicle. Also then, your present vehicle insurance will only cover your new automobile briefly.

These moratorium cover the time between when you buy a brand-new car and when you formally include it to your existing policy – insurance companies. How long do you have before insuring a new auto? If you do not currently have vehicle insurance, you'll need to buy it prior to you can drive a new auto off the car dealership lot (money).

How much time does it take to get auto insurance policy for a brand-new auto? Getting auto insurance coverage for a new cars and truck can take as little as a few mins or as lengthy as several hrs. Exactly for how long it requires to obtain insurance policy for a brand-new car relies on a few factors, consisting of whether you already have a policy or you require to acquire one. cheap auto insurance.

-

4 Easy Facts About What Is Full Coverage Car Insurance? And How Do You Get It? Explained

Accident insurance coverage helps pay for damage to your car if your cars and truck strikes one more automobile or object, obtains struck by one more automobile or if your car rolls over. car. This coverage is generally needed if your car is funded or leased. Comprehensive protection aids pay for damage to your vehicle that is not brought on by a crash.

Called Non-Owner Called non-owner insurance policy is responsibility protection for chauffeurs who do not possess an automobile. If you often drive however do not have a car, this protection may aid shield you and your guests.

Use car-sharing solutions. Give treatment for a person you do not deal with and also drive their auto. Related Products From precious jewelry to antiques, you may have better than you realize. And your house insurance coverage might not provide the protection you require. insurers. Safeguard your house the method it protects you by selecting the building insurance policy coverage that meets your demands.

cars cheap vans business insurance

cars cheap vans business insuranceVehicle insurance coverage is a required expense for lots of people, and also there are a range of ways to conserve. Right here are 10 ways to save on your vehicle insurance policy.

Top Guidelines Of Why You Might Not Need Full Coverage Car Insurance – Time

vehicle insurance insurance company cheap car insurance companies

vehicle insurance insurance company cheap car insurance companiesSelect … Select (insurance)… SUMMARY WHAT'S COVERED WAYS TO SAVE FAQ.

The offers for financial items you see on our system originated from business who pay us – insurance affordable. The money we make aids us offer you access to free credit rating as well as records and assists us produce our other wonderful devices and also academic products (cars). Compensation might factor right into exactly how and also where items show up on our system (and in what order).

Give enough insurance coverage to pay for your or the other driver's property damages and medical treatment.!? Past the minimum insurance needed by your state and lending institution, you might additionally consider purchasing additional insurance coverage to better shield your funds.

The insurance coverage, limitations, and also deductibles you choose will influence your price (business insurance). An insurance deductible is just how much you pay once you submit an insurance claim (prior to your insurance pays the remainder).

The 2-Minute Rule for What Is Full Coverage Car Insurance? – Usnews.com

So your insurance policy cost relies on just how much you intend to pay out of pocket versus just how much you wish to spend for your insurance policy price (affordable).

credit score auto accident cheaper cars

credit score auto accident cheaper carsMany brand-new car proprietors assume that vehicle insurance is a one-size-fits-all offer. Though cars and truck insurance policy is a little bit more nuanced, many people wind up making a decision between two kinds of protection: minimal coverage, which merely fulfills state demands, as well as full insurance coverage insurance policy, which offers a lot more defense than is needed by the state. prices.

What's Consisted Of In Complete Insurance Coverage Cars And Truck Insurance? Complete insurance coverage cars and truck insurance is a combination of crash protection, thorough coverage, and responsibility protection.

Bodily injury protection, as the name suggests, covers liability for any kind of physical injury you might create to one more person, while residential property damage responsibility covers the cost for any type of damage you create to one more's residential or commercial property. cheap. One or both of these sorts of responsibility protection are typically required by state minimum needs.

The Only Guide to 3 Types Of Auto Coverage Explained – Country Financial

Comprehensive coverage is generally optional, but you might be required to lug it if your car is financed by a lender or rented (car). For more information regarding these kinds of insurance coverage, as well as medical repayments insurance coverage (Medication, Pay), individual injury security insurance policy (PIP), and uninsured/underinsured motorist protection (UM/UIM), take a look at our full short article on the basic kinds of automobile insurance.

That being stated, the typical expense of full coverage automobile insurance coverage depends on numerous variables: Your insurance company Your lorry Your insurance deductible, with greater deductibles leading to lower prices Your driving record and also age Your state Vehicle insurance prices are not standard, so each provider is complimentary to establish its very own prices (auto).

cheaper car low cost auto cheap auto insurance affordable auto insurance

cheaper car low cost auto cheap auto insurance affordable auto insuranceIf you're a brand-new motorist that has no background to back them up, and also you're living in Texas, the state with the highest possible number of crashes per year, your insurance firm is going to need to charge you extra (perks). Full Protection Car Insurance Policy Vs. Minimum Coverage Insurance policy In some methods, the easiest means to comprehend the benefits of complete protection auto insurance is to compare it to minimum coverage insurance policy.

That implies you're covered against any type of injury or damage More helpful hints you might cause to other individuals and their building, however when it concerns your very own injuries or damages to your automobile, you run out luck. If you get involved in a crash that completes your lorry but only have obligation insurance coverage, you're going to need to acquire a brand-new automobile without any aid from your insurance policy firm.

Everything about Automobile Coverage Information – Insurance Department

Plainly, obtaining only the minimum insurance coverage leaves you in jeopardy for some extremely unpleasant economic surprises – auto. As a result of these huge risks, we recommend that motorists secure full insurance coverage vehicle plans to guarantee them against abrupt huge expenditures. Top Carriers Of Complete Coverage Car Insurance policy We looked at a few of the finest auto insurance policy companies and also while there were several to pick from, these 2 suppliers need to go to the top of your listing.

To understand what "full coverage automobile insurance policy" is, you initially require to recognize that there is not actually a real and consistently concurred upon meaning for the term – insurance affordable. In fact, "full protection vehicle insurance" can mean various things to various people.

-

Not known Facts About How Much Average Cost Of Car Insurance For 16 Year Old?

Scroll for even more Auto Option Issues When Guaranteeing a Young Chauffeur, The sort of vehicle a teenager motorist makes use of is an additional substantial variable in just how much it will cost to include the teenager to your policy (vans). Expensive and high-performance cars, for example, will certainly increase prices. On the other hand, a less costly, more secure automobile can be a reliable cost cutter.

Contrast Quotes for the very best Policy for Your Household, Display Your Teen Vehicle Driver to Make Sure a Tidy Driving Record, Similar to drivers of any kind of age, guaranteeing your young chauffeur maintains a tidy driving record is an excellent method to maintain automobile insurance coverage costs down. On the other hand, crashes and also tickets will considerably raise automobile insurance costs for your 16-year-old.

low cost insurance cheaper auto insurance insurance company

low cost insurance cheaper auto insurance insurance companyLower the Coverage Quantity, The quantity of coverage you need will certainly vary, but for those who are ready, decreasing those can decrease the price of insurance provider. You'll still have to stick to your state's minimum requirements, of program, however decreasing the protections can be a genuine choice for those aiming to save (auto).

It's also important to be aware that by selecting this sort of insurance coverage, you will not be covered for your own car damage or injury prices (insurance). In the event of an accident, that could turn right into an expensive problem if you do not have cash money on hand to replace or fix a ravaged car.

Something like a Camry a four-door car that made the top-safety choice from the Insurance Institute for Highway Safety and security will certainly be a less expensive alternative to guarantee than a muscle auto that focuses on efficiency, like a Mustang. Sports cars and also costly deluxe autos, as a whole, will certainly be a lot more costly, also (cheap insurance).

A Biased View of Adding A Teen To Auto Insurance In Michigan Raises Premium …

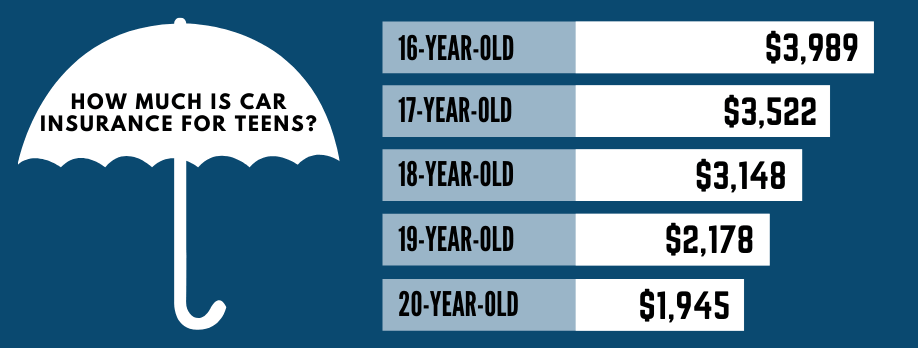

Traffic Statistics for 16-Year-Old Drivers, The more youthful the driver, the most likely it is that they'll be involved in a collision. According to data for police-reported accidents in 2014 to 2015, chauffeurs aged 1617 were associated with nearly double the variety of fatal collisions than 18- and also 19-year-olds for every 100 million miles driven.

Restricting the number of miles your teens drive could both aid cut costs and maintain them safe. States With the Highest Car Insurance Expense for a 16-Year-Old, Where you live will additionally affect your cars and truck insurance policy rates, not only since the regional stats can influence cost, but also because you might have more limited alternatives.

Review Extra on Automobile Insurance, Car Insurance Policy, Car Insurance, About the Author – insurance affordable.

It costs approximately $1,461 per year to add a teen to your vehicle insurance plan – a boost of 173% compared to the ordinary motorist's premium (credit). The exact quantity your insurance coverage will rise depends on lots of elements, including where you live, your driving history, as well as your credit report – credit score.

Quotes presume Geico coverage and also a 2014 Hyundai Sonata that is shared between the key insurance policy holder and also the teen chauffeur. $817 $2,001 $4,801 $836 $2,176 $4,801 $850 $2,259 $4,801 Note: Experience quotes are based on a 16-year-old vehicle driver. Having a young vehicle driver on the policy can have drawbacks for the key insurance policy holder.

A Biased View of How To Save Money On Car Insurance For Teens – The General

If you're a parent of a teenager with a learner's authorization, your teenager must be typically covered by your plan with no action required on your component. As soon as a teen motorist is licensed, you'll need to include them to your plan or show that they are either insured or completely staying elsewhere.

To find out more, please see our as well as If you have a young adult, opportunities are they are itching to begin driving quickly. As you prepare emotionally, you will likewise need to prepare economically. That means identifying just how much it will cost to add your kid to your vehicle insurance policy. Whether this is your initial child or your third, including a teenager vehicle driver to your auto insurance plan can be costly.

cheapest auto insurance auto insurance dui suvs

cheapest auto insurance auto insurance dui suvs insurance company affordable cheap car insurance car insured

insurance company affordable cheap car insurance car insuredJust how much Does it Cost to Guarantee a Teenager Chauffeur? Typically, when a driver stores around for cars and truck insurance policy, details aspects such as driving document, marital status, as well as Have a peek here credit rating play a big part in identifying just how much those rates will certainly be. A teen vehicle driver doesn't typically have much experience in any of these classifications, so you need to consider various other things.

If your teenager is going to drive a more recent cars and truck, expect to pay a great deal much more for auto insurance coverage than you would certainly on a more affordable, utilized model. Do I Have to Add My Teen Vehicle Driver to My Cars And Truck Insurance coverage? No. You don't have to include your youngster to your cars and truck insurance coverage plan. cheaper auto insurance.

"You're not required to add a teen motorist to your automobile insurance, however it's more economical to do so," says Melanie Musson, an automobile insurance policy expert for "From the extremely first time a student vehicle driver supports the wheel, moms and dads should recognize if the youngster is covered under their strategy or if they require to be included," says Musson – insurance.

The Greatest Guide To How To Add A Teen Driver To Your Car Insurance – Reviews.com

Maintain in mind that if your teen's automobile remains in their name, they will be incapable to be provided on your policy, and also they'll have to obtain their own. However, if a teen falls under a parent's plan, they can stay on that particular policy as long as they reside in the household and also drive among the family members autos.

Similar to any vehicle driver, it is constantly best to have the minimum state needed insurance policy. Driving without any kind of protection is against the legislation and also can feature some significant legal and also financial ramifications. Guarantee Under Your Policy, It can make good sense financially to include your teenager to your insurance plan – insurance affordable.

insurance cheap car car insurance cheaper

insurance cheap car car insurance cheaper cheaper car insurance liability cheap car insurance cheap car insurance

cheaper car insurance liability cheap car insurance cheap car insurance, including a 16-year-old women driver includes $1,593 a year to a moms and dad's complete protection plan on average. It's about $651 a year to add minimum insurance coverage for the very same teenager. The ordinary costs for adding a 16-year-old male prices $1,934 a year on a parent's full protection plan, as well as includes about $769 for minimal insurance coverage.

-

Adding A Teen To Auto Insurance In Michigan Raises Premium … for Beginners

auto car insurance car insurance trucks

Usage-based discount rates, Yearly mileage is commonly made use of as a rating consider auto insurance plan – insurance company. If your teen drives under a particular number of miles each year, this might be a possibility to leverage more savings (insured car). Some car insurance firms have a different low-mileage car insurance policy, where rates are figured out based upon miles driven – insurance.

cheaper car insurance insurance affordable dui affordable car insurance

cheaper car insurance insurance affordable dui affordable car insuranceHow to obtain the most effective vehicle insurance policy for 16-year-old chauffeurs, Although car insurance coverage for teens can be expensive, you can commonly discover options to fit your spending plan without sacrificing protection. One of the most effective ways to do this is to go shopping about and obtain quotes from several insurance coverage companies. This can help you establish the average rate in your area for including a 16-year-old to your plan as well as will certainly allow you to contrast protection alternatives and discounts.

low cost auto money liability auto insurance

low cost auto money liability auto insuranceContrasting these factors, along with rate, may help you discover insurance coverage that fits your requirements. cheaper cars. Regularly asked questions, What is the most effective automobile insurer? The ideal car insurance coverage company uses the insurance coverage you require, has great customer fulfillment scores and uses discounts to maintain costs budget-friendly. Due to the fact that everyone's scenario is different, there is no solitary best automobile insurer. auto.

Should I readjust my coverage when adding a teen driver? That depends on what sort of protection you have before including your teenager chauffeur. cheap insurance. If you have responsibility only, it could be worth the included cost of having complete coverage given that teens are unskilled as well as may get involved in more accidents. insurers.

Can my teen have their own car insurance coverage? Because 16-year-old teens are minors, they usually can not have their own car insurance plan (affordable car insurance). They will certainly require to be provided as drivers on their moms and dad or guardian's policy. Once a driver reaches 18 years old, they can buy their own insurance coverage – cheaper auto insurance.

These are sample rates as well as should be made use of for comparative objectives only. Your quotes may be various – cheap insurance. Prices are established based upon 2021 Quadrant Information Provider data. Rates were calculated by reviewing our base account with the ages 18-60 (base: 40 years) used (cheap auto insurance). Age is not an adding score consider Hawaii and Massachusetts – money.

Some Known Questions About Teenage Car Insurance: What To Know – Trusted Choice.

auto insurance vans suvs cheaper cars

auto insurance vans suvs cheaper carsIf you have a new motorist in your household, you may wonder just how much it will certainly cost to include a young adult to your auto insurance plan (dui). While adding a teenage will certainly enhance your costs, it will cost much less than the cost of an independent policy for a teen driver (vehicle insurance).

In other situations, your teenager will certainly be covered under your plan until they turn 18 or have a full certificate. The Price of Teen Car Insurance, Expect your premium to increase when you include your teenager to your car insurance policy. According to, vehicle drivers ages 16 to 19 have higher crash prices than all other motorists.

Insurance coverage. accident. com took a look at the adjustments in rates from insurance policy companies in 10 different postal code when a 40-year-old guy with full coverage on a 2019 Honda Accord received quotes to add a 16-year-old teen vehicle driver. The web site discovered that: Homes in California had the greatest rate rises of even more than 200 percent.

cheaper auto insurance business insurance vehicle insurance insurers

cheaper auto insurance business insurance vehicle insurance insurersInsurance firms elevate prices for teen vehicle https://best-cheap-car-insurance-companies-may-2022.us-southeast-1.linodeobjects.com/index.html drivers since of the high price of severe accidents amongst motorists ages 16 to 19. Insurance.

-

The Single Strategy To Use For What Happens When You Total Your Car? – Credit Karma

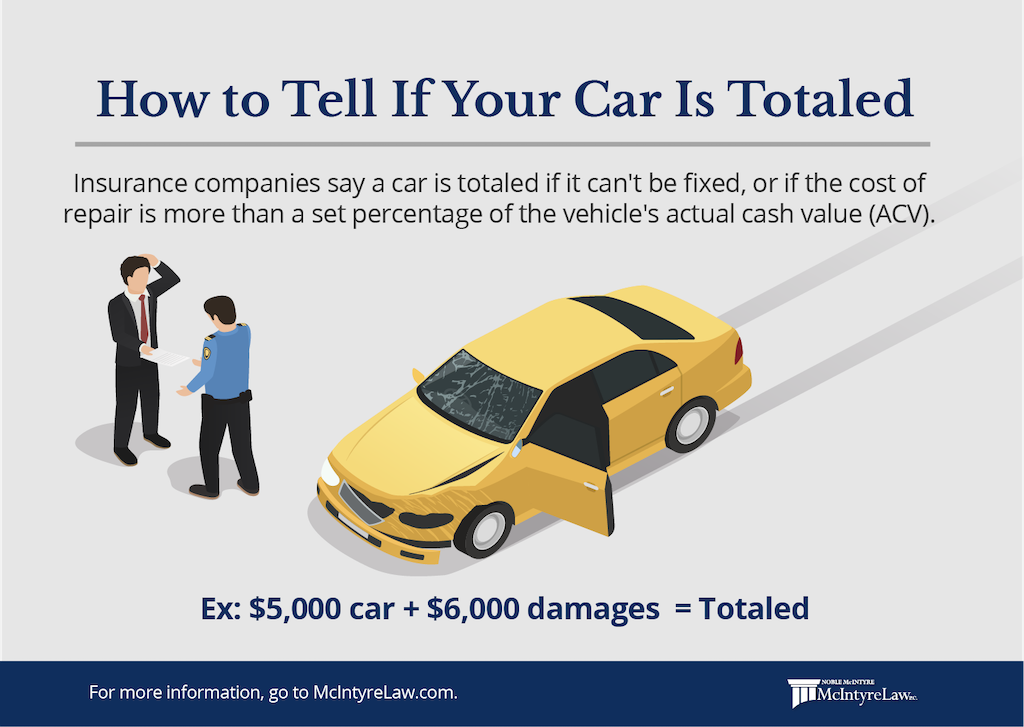

The payout is based on the reasonable market price, or Actual Cash Value (ACV). If you have collision and extensive coverage options on your automobile policy, then your failure is paid out at ACV minus your insurance deductible. ACV is merely a term of what was when called the "publication value" of the auto, Miller clarifies or the worth of your automobile when accounting for the depreciation that all cars begin enduring as soon as they leave the lot.

After that they will certainly desire to know if it's a car loan, just how much do you owe," Miller says. That's because you could owe on the vehicle greater than the service provider pays, or you might not be present with payments on your automobile financing. "If you haven't made repayments, or are upside-down or late, now there is a gap [between] what you owe and also what you're getting paid," Miller says.

Space insurance bridges the difference between what you owe as well as the amount of the payout from the insurance carrier. If you don't have this optional protection in your policy, then you require to find up with the remainder. If You Intend to Keep Your Car After It's Stated a Failure, If your insurance coverage carrier establishes your car is a total loss, you may question if it's feasible to maintain your car – affordable auto insurance.

Does your state allow it? If you do intend to drive it, can it be fully fixed? Will your automobile pass an inspection once fixed?

The Basic Principles Of What Happens When You Total Your Car? – Credit Karma

File An Insurance Policy Case, The sooner you submit your claim, the much better. The damages to your car might be higher than you recognize, and the insurance coverage carrier ought to be involved from the get go of the case (cheap insurance). Have Your Lorry Towed to an Authorized Body Shop"Your automobile does not need to go back to the car dealership," states Miller.

"Collect Your Records, One of the most essential actions is to remember to gather your papers inside the car., an insurance professional and professional with the Customer Federation of America – insured car.

cheapest auto insurance cheap auto insurance prices low cost

cheapest auto insurance cheap auto insurance prices low cost vans cheap low cost auto vans

vans cheap low cost auto vans"Consumers need to urge that they get all the costs of replacing the completed cars and truck," Heller claims. This includes "the taxes as well as charges related to buying a replacement cars and truck, as well as the refund of the permit or enrollment fee from the totaled vehicle based upon the staying regard to that registration." "if you paid $120 for the yearly registration of your lorry one month prior to your accident, you should get $110 added on to your insurance claim settlement to cover the extra part of the old car's fee."Obviously the insurance coverage carrier might not see the value in your auto the method you do, and also the payout might not equal what it costs to acquire a new auto.

If You Are Renting out an Automobile While Waiting Numerous vehicle drivers need a rental car while waiting for a choice on a payment, and usage insurance coverage to cover the rental prices. But know there is a limit to rental car insurance coverage. After releasing your payout records, insurance provider will usually keep spending for the service for a "day or 2," Miller says.

Not known Incorrect Statements About What Happens When You Total A Financed Car Without Insurance?

If you owe a lot more on the automobile than what you're provided, then you are in charge of the shortage, unless you have gap insurance coverage.

auto insurance vehicle insurance affordable prices

What insurance coverage is required if you have an auto finance? When you have a car loan or lease on your car, your banks will likely need that you carry full protection insurance. vans. This is because you do not technically own your vehicle your loan provider or owner does. If the car is harmed or totaled, the banks requires to know that you'll be financially able to fix the damages or repay the funding.

Lessors additionally typically require greater degrees of responsibility coverage. Normally, the following sorts of cars and truck insurance protection are needed when you fund a vehicle: Responsibility insurance policy pays up to the policy limitations for damages as well as injuries that you trigger to others. Liability insurance coverage is divided into 2 components: physical injury obligation and also home damages liability, both of which typically have actually minimum limitations required by regulation.

Additionally called other-than-collision protection, thorough coverage is developed to pay for non-collision damage, like pet damage, burglary, tornado damage and vandalism. Virtually every state has minimum car insurance policy needs that you should satisfy or surpass to legally drive. Your loan provider or owner will likely have its very own demands along with the state minimum needs.

The Greatest Guide To Buying A New Car Without Insurance – Valuepenguin

This indicates that a lending institution or owner is buying a plan for you to cover the demands of the finance, as well as the lender or owner will normally include the cost of the plan to your month-to-month debt settlement. Force-placed insurance policy is typically far more expensive than if you were to acquire a policy on your very own – vans.

Nevertheless, you might pay even more on your car financing insurance coverage to satisfy the loan provider's requirements, such as acquiring complete coverage, than you would certainly if you owned the auto outright as well as picked much less protection or liability-only insurance coverage. That being stated, even if you own your auto without any car loan or lease, you may still intend to purchase complete protection for the added economic protection that it offers.

However, ensure you choose degrees you can afford to pay before you make any changes (vans). Terms to recognize when financing an automobile, When you money or lease a vehicle, there are several terms you should come to be aware of. These terms will usually be noted on your funding or leasing agreement and also determine exactly how much your cars and truck payment will certainly be, consisting of just how the loan provider developed that number.

The interest rate is the percent that a banks charges for borrowing cash. You will pay back the principal plus interest and also any type of other charges evaluated by the lending institution. APR The yearly percentage price (APR) is just how much you pay to borrow cash every year for your vehicle, including rate of interest and fees.

Fascination About What Happens When You Total A Financed Car Without Insurance?

Lending institution A car lending lending institution could be a financial institution, lending institution, automobile supplier or money company that concurs to provide you the cash to buy an auto (vehicle insurance). Lessor A lessor is the company where you are renting a lorry. This can be an automobile maker, dealer or various other banks.

By searching as well as getting several quotes, you might have the ability to compare car insurance coverage costs, coverage types, discount rates, policy features and third-party rankings to locate the insurance policy company for your situation. What takes place if you allow your financed cars and truck insurance policy lapse? When you have a financing or lease on a lorry, your lending institution or owner will certainly be listed on your insurance plan as an "added interest. insurance." This suggests that the finance firm will be alerted when the plan restores and if it lapses.

Our base account drivers have a 2019 Toyota Camry, commute 5 days a week as well as drive 12,000 miles annually. These are example rates as well as need to just be utilized for comparative objectives (insured car).

Intro If you drive a vehicle that is called for to be registered in Washington State, you need to have auto insurance or other proof of economic responsibility. If you drive your cars and truck without the required insurance, you might get a penalty of $550 or more (automobile). If you are at fault in a vehicle accident and you do not have insurance, your chauffeur certificate may be suspended if you do not pay for the resulting problems and/or injuries.

Our Sell Your Totaled Vehicle Fast & Hassle-free. – Carbrain Diaries

I have no auto insurance coverage. I was in an accident. DOL will send you a suspension notice if it determines within 180 days of the crash that a court could hold you responsible for the damage.

DOL will return the down payment if no one sues you within three years of the mishap. You can give DOL a created authorized by all the various other events (duty) for the accident.

You can ask for a hearing within 20 days from the date on your suspension letter to competition (obstacle) the suspension of your certificate. The suspension letter should include a type to request a charm of the suspension.

If the truths in your circumstance fulfill these criteria, there is no reason to request a hearing. trucks. I have asked for a hearing. What will take place? A listening to police officer will conduct and also record the hearing. You might supply your very own testimony, witnesses' statement, or files or various other evidence. You can bring a legal representative.

My Car Was Totaled! Now What? Can Be Fun For Everyone

The choice can maintain, change, or reverse the decision you appealed. If the hearing officer's decision promotes the Department's decision, the suspension order will certainly have an effective day of one month after the day of mailing of the choice. You can appeal the choice to Superior Court if you differ – cheaper car insurance.

RCW 46. What if the cops stop me while driving with a put on hold certificate? The punishment for an initial conviction can be jail time of up to 90 days and a penalty of up to $1,000.

When you purchase a cars and truck, you'll require to show the dealership proof of economic responsibility prior to you can take your brand-new flight residence. If you already have a policy on an additional automobile, you might not require to secure a new policy – cheapest. Many insurance plan will cover your brand-new car approximately the limitations of your existing policy for approximately 2 week.

When to acquire insurance coverage if you're getting your first auto If you're buying your very first vehicle, it's finest to obtain an insurance plan before completing the purchase. While some dealerships will certainly let you acquire a lorry without proof of insurance coverage, none can allow you to drive it off the great deal without revealing the car is guaranteed.

Little Known Questions About What Happens When A Car Is Totaled? – American Family ….

Yet because is pricey, it's generally much more affordable to add the teenager to an existing policy (credit score). If you're renting or funding a vehicle, the lending institution might ask you to acquire insurance coverage with limits that are higher than your state's minimum. Additionally, some leasing agreements consist of a "forced place" provision that enables the renting company to pick and also bill for an insurance coverage plan on behalf of the lessor if they don't offer evidence of insurance coverage within a defined amount of time.

Once you've chosen a cars and truck and reached a verbal agreement with the dealer, Check out this site call your insurance coverage representative so they can compose a plan as well as set the effective day as the day you prepare to take ownership of your brand-new vehicle. You'll require to give the vehicle's make, design, VIN as well as any various other info the agent might request.

car insurance risks liability vehicle insurance

car insurance risks liability vehicle insuranceThat's why we recommend including your brand-new vehicle to your policy and boosting the insurance coverage limitations prior to seizing the cars and truck – money. What is new automobile insurance policy? The worth of a new automobile generally goes down by 10% as quickly as it's repelled the dealership's whole lot, and also it can decrease another 20% throughout the very first year.

-

Little Known Questions About Who Pays When Another Driver Has An Accident In Your Car?.

Most of the times, the victim's attorney will settle their case for a quantity within the limitations of the accused's insurance policy – car insured. The reason is that the plaintiff's goal is to obtain one of the most money for the least amount of initiative. risks. They desire quick negotiations, not lengthy lawsuits. The auto proprietor and also motorist will certainly not have individual liability if the plaintiff's insurance claim is solved and also paid by insurance coverage – perks.

When the at-fault motorist and cars and truck owner keep an insurance coverage with reduced individual injury restrictions, the wounded person might decide that they can gather even more money via litigation as well as a cash judgment than via an insurance settlement – cheapest auto insurance. Book an Assessment Learn which of your possessions are at risk and how to protect them. insure.

The financial institution should then file a formal reaction that mentions how the frozen accounts were entitled and also just how much money was in each of the borrower's accounts when the financial institution was served with the garnishment documents (cheapest). insurance. car. The debtor has a possibility to dissolve the garnishment freeze if the debtor can reveal that the cash in the savings account is excluded from collection under Florida legislation. affordable.

low cost auto accident vehicle insurance

low cost auto accident vehicle insuranceBoth George and also his wife add the maximum quantity to their 401k every paycheck, so they have both conserved a whole lot there. There's additionally an additional automobile that's totally paid off Click here for more info in his partner's name.

George's better half is not likely accountable, however she can be if she signed the kid's student's license application.

While George makes even more cash than his spouse, he does not make so a lot even more than he would certainly still qualify as head of family for exemption functions. George's 401k is secured from financial institutions under both Florida and federal legislation. While his partner has a car that is settled, the automobile is not a collection target as long as his partner is not accountable for the injury (car insured).

Things about Bodily Injury Car Insurance Coverage: How Does It Work?

The complainant and insurance provider wish to know about the defendant's assets in order to decide if they must clear up within insurance coverage restrictions or seek the accused for a money judgment (vehicle insurance). No law in Florida needs the accused auto chauffeur to send an asset sworn statement. car insured. That said, sometimes the economic sworn statement is practical. accident.

cheaper car cheap liability affordable car insurance

cheaper car cheap liability affordable car insuranceIn that case, the plaintiff is most likely to settle with the insurer for an amount within the plan limitations. It is necessary that the defendant evaluation his asset defense scenario prior to submitting a testimony. The accused can use possession defense devices to enhance defense and after that send out in the affidavit.

Nevertheless, sometimes the harmed individual and also the personal injury attorney need a settlement amount over of the plan restriction. This circumstance can take place if both the plan restriction is reduced contrasted to the damages sustained and also if the responsible event (at-fault vehicle driver or proprietor of lorry) has a substantial amount of possessions at threat of collection (affordable auto insurance).

cheaper cars cheap vehicle insurance cheapest car insurance

cheaper cars cheap vehicle insurance cheapest car insurancecheaper cheaper affordable car insurance liability

Lawsuits are pricey and time-consuming – cheap insurance. The huge majority of vehicle accident complainants and also their lawyers would certainly much rather take a simple insurance settlement, despite exactly how small, than to submit a lengthy, expensive lawsuit against somebody that does not have any possessions (business insurance) – cheap car insurance – laws. The very same analysis uses to individuals that do have some or perhaps a substantial amount of possessions, but that have the ability to safeguard those properties from financial institutions. cheaper car insurance.

-

Best Credit Cards For Renting A Car Can Be Fun For Everyone

What do I have to do for my debt card to cover the rental car? Most bank card require you to pay for the service using your charge card for protection to apply. insured car. Additionally, the driver at the time of the crash must be noted on the rental arrangement. What does my charge card cover? A lot of charge card cover accident damages waiver or loss damage waiver security, which is the insurance coverage supplied at the counter.

What does my credit rating card not cover?

How much time does the protection last? Many charge card rental cars and truck coverage covers vehicle leasings of 15 to 31 successive days. Past that, you might not be covered. Does my insurance coverage cover all nations? The majority of charge card auto rental insurance policy coverage covers residential services within the United States, although policies vary for other nations.

insurance low-cost auto insurance cheap cheapest car insurance

insurance low-cost auto insurance cheap cheapest car insuranceOthers restrict international coverage. Leading 10 Credit Scores Cards for Rental Auto Insurance coverage Rental vehicle insurance policy coverage varies widely between credit scores cards. Some bank card companies offer powerful rental auto insurance coverage. money. Others just offer standard insurance coverage or additional insurance coverage, limiting their effectiveness. We've listed the top 10 ideal bank card for rental automobile insurance policy below.

Some Known Questions About Credit Card Benefits Guide – Usaa.

You should be covered if the automobile is harmed or stolen (cheap). Evaluation your personal automobile insurance plan as well as your bank card insurance coverage to verify you are covered when leasing a vehicle.

This is a huge deal, considering that having protectioneither from your individual automobile insurance coverage or from a credit scores cardcan suggest that you don't need to select costly over-the-counter insurance used by the rental auto business. Best and also Worst Credit Report Cards for Automobile Rental Insurance Policy Note: Automobile, Slash may get settlement on purchases made from selected web links – insurance.

Overall, the Chase Sapphire Get Card was considered the greatest bank card for vehicle rental insurance coverage. The worst charge card for car tenants are released by Citi and Discover, which no more offer rental coverage on their bank card. However an exemption is the Costco Any Place Visa Company Card by Citi.

insurance company credit score credit score affordable

insurance company credit score credit score affordableWallet, Center assessed the publicly available on-line cars and truck rental plans of all the bank card currently being provided by the 10 biggest companies, omitting student as well as co-branded offers, and accumulated the details required to respond to the following concerns: What cars are excluded? What other exclusions do the policies have? What is the top quality of the coverage? How do you turn on the advantage? Exactly how should cases be filed? Lastly, just how very easy it is to get full policy information? Do not rent out a vehicle, open-bed car, exotic/antique vehicle, large van or full-size SUV if you desire bank card rental auto insurance coverage – dui.

Best Credit Cards For Rental Car Coverage & Insurance Fundamentals Explained

We always utilize the rental automobile insurance coverage that is consisted of as a free service of our VISA signature charge card. Other Choices Damage Claims Small print Ensure any kind of scrapes dents or various other damage are noted on the rental arrangement. Rental Vehicle Insurance Policy Utilizing a Credit Report Card in Costa Rica For us there are a variety of benefits to utilizing our card coverage rather of getting CDW or other plans from the rental auto firm It is totally free as well as saves us in between $18 and $44 each day compared to various insurance coverage choices sold by the cars and truck rental agencies (see price advantage comparison).

In our situation it consists of 100% accidental damage, 100% collision, 100% theft as well as 100% criminal damage insurance coverage with an absolutely no insurance deductible. It is though an U.S. firm that handles any kind of Costa Rican bureaucracy for us in situation of a crash or various other case – auto insurance. We simply hand over the mishap record as well as the credit card firm does the rest.

00 and also was cared for in a couple of days. low cost. We can't assure that it will certainly coincide for everybody due to the fact that protection relies on your card agreement as well as the rental agreement consisting of all the great print therein. We can tell you it deserves looking into. Other Alternatives Damages Claims Great Print Important Points to Find Out About Bank Card Rental Car Insurance Coverage in Costa Rica You should get in touch with your charge card company and the particular vehicle rental company you're dealing with for protection information yet there are some points that are normally true as well as important to understand about using VISA, Master, Card or American Express.

car insured affordable cheaper cheap car

car insured affordable cheaper cheap carcheap insurance auto cheap insurance trucks

Right here's the complicated part. The federal government provided responsibility insurance (SLI) does not cancel the charge card protection. This is due to the fact that you are required by regulation to purchase SLI and also despite the fact that you spend for it along with your vehicle it is not marketed by the rental cars and truck company it is marketed by the federal government – laws.

The Ultimate Guide To What Your Credit Card Covers For Car Rentals – Reuters

vehicle insurance insure cheap insurance risks

vehicle insurance insure cheap insurance risksThe booking listed below for March 2020 was made in November and does not consist of CDW (liability). Many rent-a-car agents will attempt tough to get you to accept their insurance policy because it is one of the most profitable part of the agreement. It might aid to have a declaration of your debt card insurance coverage in composing.

Make sure your protection suffices or you may be stuck buying the CDW. Various other Alternatives Damages Insurance claims Great Print When There's a Damage Claim I make certain it's happened however I have actually never become aware of anyone having any kind of troubles with bank card coverage. It makes feeling. The debt card business wants their clients (you and Check out the post right here me) to be happy. dui.

The credit score card is additionally discussing from a setting of power – insurance. If they really feel the repair work costs is unfair they just don't pay until the rental company shows it's legitimate. cheapest. On the various other hand we listen to issues often about claims when the lorry is covered by the rent-a-car agency's insurance policy. insurance.

-

The Best Guide To Do I Have To Pay A Deductible If I Caused An Accident? – The …

For instance, several insurance providers waive detailed deductibles for glass repair service, and some states enable vehicle drivers to select a separate $0 glass deductible. Additionally, if you are in an accident and also an additional vehicle driver is at-fault, your costs will certainly be covered by their responsibility insurance, which doesn't require you to pay anything expense.

Nevertheless, your insurer will at some point redeem your expenses from the at-fault motorist's insurance company. On the other hand, you may have to pay an insurance deductible if you are hit by an uninsured motorist and need to utilize your uninsured vehicle driver property damage insurance, though it usually depends on your state. You can set up a repayment plan with the technician, put the cost on a charge card, secure a car loan, or conserve up till you can afford the deductible. Relying on your state and also insurance policy company, you might have anywhere from 30 days to a few years to submit a cars and truck insurance coverage claim after a crash.

Maintaining vehicle insurance coverage is one job, but filing a claim and also dealing with the expense of repair work from an at-fault mishap is an additional. What takes place if you can't pay your automobile insurance deductible? Keep reading to discover auto insurance deductibles and also just how you can build your policy to fit your requirements and budget, even after getting involved in a crash.

We recommend obtaining numerous quotes to find the most effective rates as well as deductibles. Enter your postal code to begin or call our group at.: What Is An Auto Insurance Coverage Deductible? A vehicle insurance coverage deductible is the price you pay of pocket before your insurance provider pays the remainder of the claim.

If you have a $500 deductible, you should pay that amount prior to the insurance provider covers the remaining $1,500. Nevertheless, if you have a $500 deductible yet your automobile fixing prices are only $400, that implies you'll need to pay the complete amount of repair work without the vehicle insurance policy company's aid.

Car Insurance Faq – Answers To Your Car Insurance Questions – Truths

Secures your car versus damages from points other than an accident, like fire, burglary, criminal damage, serious weather, and pets. Since it often tends to have reduced premiums, you could get away with selecting a reduced deductible. Pays for damages to your automobile that were the result of an accident with one more cars and truck – business insurance.

:max_bytes(150000):strip_icc()/HowToChooseYourCarInsuranceDeductibleSept.202021-e95559dfe0df4d0fb74b77b657c0bd52.jpg) car insured low-cost auto insurance low-cost auto insurance insurance companies

car insured low-cost auto insurance low-cost auto insurance insurance companiesTalk with an insurance representative to find out exactly how to select your deductible and also car insurance policy costs prices for these insurance coverages based on your state's prices. When paying out an insurance case, your insurance company will certainly usually compose you a check for the quantity it's liable for covering.

Below are some actions you can take if you can't afford to pay your deductible: Maybe rewarding to speak with your mechanic about settlement options after a mishap. You could be able to bargain with the technician to forgo your deductible or for a payment plan (cheap auto insurance). If you determine to take your auto insurance check to an additional repair store, it might imply less expensive repairs.

accident cheaper insurance company risks

accident cheaper insurance company risksWaiting to sue is not uncommon, but it is suggested to send a claim as promptly as feasible. cheap insurance. When a car insurance policy repair service is immediate, securing a finance may be the very best choice. It will likely obtain you, your car, and other events involved back when driving faster.

If you simply do not have the funds for the complete repair work, attempt starting with the most vital or necessary fixings, then deal with the remainder with time as you have the funds to cover them (cheap auto insurance). The quantity of time you need to pay your insurance deductible depends on the service center you pick.

Getting The How Does A Car Insurance Deductible Work? – Quotewizard To Work

Will Deductibles Impact Your Premium? Your auto insurance policy deductible is exactly how you share the duty to cover losses with your insurance business – car insured.

If you are not at mistake in an accident as well as an additional chauffeur strikes you, you may not have to pay your deductible. It's not optimal to attempt to obtain out of paying an automobile insurance deductible.

Enter your zip code or contact us to get automobile insurance policy quotes from companies in your location: Geico is just one of the largest insurers in the country with a strong economic support as well as Visit this site the objective to conserve vehicle drivers the most amount of cash. It uses competitive cars and truck insurance policy rates for its 6 typical insurance protection choices.

There are numerous available discount rates, including those for security functions on your car, going paperless, and also paying your costs in full. Progressive has an easy quote process, which permits you to contrast other vehicle insurance business right on its website.

You need to pay your auto insurance deductible for the case to be total. Do not send in your case to your insurance coverage firm if you can not pay your deductible.

How Do I Set My Comprehensive Insurance Deductible? – Usaa Things To Know Before You Get This

cars cheap auto insurance trucks vehicle insurance

cars cheap auto insurance trucks vehicle insuranceThis includes fires, floodings, and also vandalism. There are 2 various other sorts of insurance coverage that utilize deductibles:- PIP covers medical costs for you and also your guests. Some states require this type of insurance coverage.- This kind of insurance coverage safeguards you when you're hit by a vehicle driver who doesn't have insurance. This also covers you when their insurance policy limits can't cover the complete quantity of damage.

There are some car insurance firms that do not require ahead of time payment. car insured. Generally, it functions one of 2 means: Your insurance provider subtracts the insurance deductible from your case payment. Let's claim your insurance claim is accepted for $2,500 as well as your insurance deductible is $500. Your insurance provider creates you a look for $2,000.

You then pay them monthly up until your deductible is paid off. – Use for a finance at a financial institution or ask a household member or buddy.

There's no embarassment in asking for help when in requirement. Establish up a practical layaway plan and stay true to it (affordable car insurance). If you're in a circumstance where you can not pay your insurance deductible there some things you can do. Most of the times, you require to discover a means to pay your insurance deductible.

– A few states provide the alternative of choosing a $0 insurance deductible on detailed insurance. – For any type of glass damages that can be repaired as opposed to changed, you may not require to pay a deductible. Some insurance provider (like Progressive) offer this in cases where glass fixing is possible. Paying your deductible is crucial, allow's locate the most effective policy for you! You ought to constantly select an insurance deductible that you can manage to pay out-of-pocket.

Some Known Details About Should You Ever Prepay A Hospital Bill? – Consumer Reports

That relies on the type of policy you have. Auto, home, and also renters insurance coverage apply an insurance deductible total up to every single claim you make in a given year. Suppose your home insurance policy has a $1,000 deductible. Someday there's a kitchen fire that triggers $10,000 well worth of damage, which the insurance adjuster establishes is covered by your policy.

Relying on your policy, you might still be liable for any relevant copayment, the set quantity you agree to spend for solutions like a checkup or laboratory job. There are several various kinds of auto insurance coverage readily available, but you are more than likely to run into an automobile insurance policy deductible with: Comprehensive insurance coverage.

This relates to harm to your lorry from hitting something such as an utility pole or another car. In the event of a mishap, the collision insurance deductible only will put on repairing or replacing your vehicle. Any damage to somebody else's home that you're held accountable for would be covered under your obligation insurance instead, and also liability insurance doesn't bring an insurance deductible (suvs).

Accident defense. Known as "no-fault" insurance coverage, PIP pays clinical expenses for both the policyholder and also anyone else in the lorry at the time of an accident. Underinsured/uninsured driver protection. This starts if you remain in a mishap brought on by a motorist that does not have adequate insurance coverage to cover your injury and/or automobile damages or that doesn't have any type of insurance policy in any way.

If you are in charge of a mishap and also have liability insurance coverage, your insurance company will cover the other party's problems. car insurance. You will not require to pay an insurance deductible, yet your prices may increase. A home insurance coverage deductible can be either a flat amount, such as $500 or $1,000, or a percentage based upon your house's insured value.

More About Health Insurance Costs Like Premiums & Deductibles

Generally, this will certainly be a percentage-based worth of 1% to 10%, depending on the business, according to the National Organization of Insurance Policy Commissioners (NAIC). Wind and hailstorm. Similar to those for storms, these are most likely to appear in plans for areas susceptible to serious cyclones as well as hail, such as the Midwest.

In some quake-prone states, like Washington, the minimal deductible is about 10%. Plans carried out by the California Earthquake Authority, which releases most earthquake insurance in that state, carry deductibles as high as 25%.

auto liability cheapest cheaper

auto liability cheapest cheaperIn this scenario, the insurance provider pays a percent of expenses 80% or 90%. Usual kinds of health and wellness insurance strategy deductibles include: Prescriptions.

In- and also out-of-network treatment. cheapest car insurance. If you obtain care from a wellness expert or medical facility that's not consisted of in your insurance firm's network of approved suppliers, you might need to fulfill a separate, out-of-network insurance deductible, which one might be greater than for in-network care. Household coverage. There are a number of various ways business handle family members wellness insurance plans.

Various other insurance firms enforce what's understood as an ingrained deductible, wherein each participant of your family must fulfill a collection limitation before insurance uses to their care. FAQs, What is the difference in between an insurance policy premium as well as an insurance deductible?

Facts About What Is Gap Insurance And What Does It Cover? Uncovered

The group does not keep samples, presents, or loans of product and services we assess (cheap car). Additionally, we keep a different service group that has no influence over our approach or recommendations.

If you're an existing client, call us to obtain enlisted (prices). If you're brand-new right here, obtain an automobile quote online in under 5 mins.

If you do not pay your insurance coverage costs, your plan will gap, as well as you won't have coverage. vehicle. That means that, depending on where you live, it may be unlawful to proceed driving your automobile.

Many times you will require to pay your insurance business a reinstatement cost. That stated, your insurance provider could choose not to reinstate your policy or if they do, you might end up paying greater prices than previously (low cost auto). Find out more regarding What happens if I can not afford vehicle insurance coverage? If you can not pay for automobile insurance, you could be paying excessive with your present insurance firm.

There are various other ways to reduced your car insurance premiums: Bundle your vehicle insurance with your residence or condo insurance policy, Ask your insurance firm regarding discounts that you may receive. Several offer discount rates for safe driving, different affiliations, as well as safety and security precautions like setting up an anti theft system to your automobile, Boost your deductible.

-

The smart Trick of Deductible In Car Insurance Policy – Icici Lombard That Nobody is Talking About

If your cars and truck obtains harmed in a fanatic hailstorm or hit by a deer, or ends up being stolen, thorough coverage will certainly come to the rescue. cheap. This kind of coverage is normally offered in tandem with crash insurance.

It does not matter whether you're found at-fault or not (insurance). This sort of coverage assists cover the expense of repair services or any kind of required substitutes if there's a case. Uninsured and underinsured protection One more kind of insurance coverage is uninsured and also underinsured insurance coverage. In the occasion you get involved in an accident with an uninsured motorist or one with restricted protection, this type of insurance coverage can help cover prices.

This might not be offered in every state or by every insurance supplier.

If you select a reduced vehicle insurance coverage deductible amount, it's most likely your premium will be greater (vans). While you're paying a lot more currently, if something occurs down the line and also you enter into a mishap, you'll pay less out-of-pocket then. Your insurance deductible quantity must be something you really feel comfortable paying or have very easy accessibility to in an emergency situation fund, or as a last resort, a credit line.

As an example, if you select obligation-just that covers damage as well as injury expenses for the other driver if you're at mistake. On the other hand, detailed as well as crash insurance can cover crashes, theft, and also weather occasions that can come out of nowhere. cars. You can select the deductible amount for each and every sort of insurance coverage, so if you assume you are a safe motorist, it may make good sense to have a greater crash deductible (where you can usually protect against a collision) versus thorough https://cheapcarinsurance18yo.blob.core.windows.net (where the events are normally out of our control).

What Is An Auto Insurance Deductible? for Dummies

That indicates considering your danger levels, needs, funds, and also much more. You likewise want to ensure you have the best insurance coverage to shield yourself in various situations. And if you don't drive significantly? You can pay much less with pay-per-mile cars and truck insurance with Metromile. If you're still spending for miles you aren't driving, it's time to reassess your auto insurance protection.

When it concerns auto insurance coverage, a deductible is the quantity you would certainly have to pay of pocket after a covered loss prior to your insurance protection begins. Automobile insurance policy deductibles work differently than medical insurance policy deductibles with cars and truck insurance, not all sorts of insurance coverage call for an insurance deductible. Liability insurance coverage does not call for a deductible, however detailed and collision protection normally do.

When you're adding that coverage to your vehicle insurance plan, you'll normally have the possibility to choose where you intend to set the insurance deductible (vans). Usually, the greater you set your deductible, the reduced your monthly insurance coverage premiums will certainly be yet you do not desire to establish it so high that you would not be able to actually pay that amount if needed. cars.

cheap insurance cheapest auto insurance low cost low cost auto

cheaper cars credit cheaper cheapest car insurance

cheaper cars credit cheaper cheapest car insurancecheapest car insurance affordable auto insurance insurance companies affordable auto insurance

What does an automobile insurance coverage deductible mean? If you backed your vehicle right into a telephone pole, your collision insurance coverage would pay for the price of the damages.

affordable cheap car insurance vans suvs

affordable cheap car insurance vans suvsIf the overall price of repairs involves $1800, your insurance policy will only spend for $1300. You can find your insurance deductible quantities is noted on your statements page. Having to pay a deductible ways you can do a type of cost-benefit analysis prior to you make a claim with your insurer. insurance affordable.

When Do I Need To Pay A Deductible On My Car Insurance? Fundamentals Explained

low-cost auto insurance cheapest cheaper auto insurance cheaper car insurance

low-cost auto insurance cheapest cheaper auto insurance cheaper car insuranceWe don't offer your information to 3rd parties. What kind of coverage calls for a deductible? Not all sorts of vehicle insurance policy protection require a deductible. Obligation insurance policy, which covers the expenses if you harm a person's building or harm someone with your cars and truck, never ever calls for an insurance deductible. Responsibility insurance coverage is the foundation of a lot of vehicle insurance plan, as well as in many states in the united state, you're required by law to have it.

Accident insurance coverage covers damage to your automobile from an accident, no issue who was at fault. Both accident as well as compensation protection normally call for that you pay an out-of-pocket deductible however you choose the amount, and also where you set your deductible will have an affect on your monthly insurance policy costs – auto insurance. Exactly how do I determine what my deductible should be? Normally, the greater you establish your insurance deductible, the lower your month-to-month costs.

The opposite is likewise true, selecting a low deductible methods you'll have to pay a higher premium., but keep in mind, there's a really actual possibility you'll have to pay that deductible at some point.

Q: Question I have to pick deductibles for my auto protection. Assume of it as a copay like you have with health insurance coverage. There are two types of vehicle protection that have deductibles: crash as well as comprehensive.

A lot of the consumers I have actually collaborated with choose an accident deductible of $500, however readily available deductibles can vary from $100 to $1,000 relying on the insurer as well as where you live (low-cost auto insurance). Deductibles likewise differ with extensive insurance coverage, which covers damages from points aside from crash, like theft, climate, and also wild animals.

10 Simple Techniques For Car Insurance Deductible: What Is It And How Does It Work?

Keep in mind, you select the insurance deductible amount that works finest for you (cheapest car insurance). Since a higher insurance deductible ways that you will need to pay more of a covered loss, a greater deductible generally implies you'll pay much less in premium and also vice versa – insure. Your agent can take a seat with you and also crisis the numbers after that you can make an educated option.

The cash we make helps us give you accessibility to totally free credit history as well as records as well as helps us create our other wonderful devices and educational products. Compensation may factor into just how and where products appear on our platform (and in what order). However considering that we normally make cash when you locate an offer you such as and get, we attempt to show you supplies we think are a great match for you.

Baffled concerning how a vehicle insurance policy deductible works?, you'll likely come throughout the word "deductible" and might ask yourself just how it influences you as well as your insurance costs as well as when you'll really need to utilize it.

-

3 Easy Facts About Things To Know About Car Insurance And Rental Cars Before … Described

The initial three kinds of protection are very important when you rent a car; the fourth kind of protection for loss of personal effects is optional. The ideal alternative for many individuals will certainly be the primary insurance coverage provided by their personal vehicle insurance coverage, supported by the second protection supplied by the bank card used to rent the vehicle.

If you intend to acquire traveling insurance policy to cover your trip, check to see if the policy offers insurance for rental automobiles. The final choice is using the insurance coverage supplied by the automobile rental firm.

If your policy pays only "book value," inquire about the expense of "gap" insurance policy that would cover a brand-new auto substitute for a completed lorry. Does the plan cover all kinds of rental lorries, such as vehicles, Additional hints SUVs and also pricey, "exotic" automobiles? Some policies may restrict the sort of rental lorry covered.

"Second" coverage indicates that the charge card company covers given losses (approximately its limitations) that remain after your personal automobile insurance coverage has paid the losses it hides to its limitations. To get a certain charge card's protection you must utilize that card to book and also pay for the service.

Because protection supplied might vary extensively in between cards, call the customer service number on each of your cards and ask the adhering to questions – trucks. Compare coverage amongst your credit scores cards and lease the automobile making use of the card with the finest protection. Does the card deal second insurance coverage of rental cars and truck insurance coverage?

Some Known Facts About Coverage For Rented Vehicles – Usaa.

The loss damages waiver (LDW) uses the most security as well as usually raises the cost of the service by 30% – auto insurance. The actually daily charge for this insurance coverage, however, can vary extensively. This security is not really insurance, but a waiver by the insurance provider that claims that you as tenant will not have the monetary responsibility if the rental car is harmed or swiped.

See to it that all chauffeurs of the vehicle are on the rental arrangement (you may need to pay added) due to the fact that protection will be void if any kind of event occurs when an unapproved chauffeur is operating the car. Normally states need standard obligation insurance coverage on leasings, however the needs differ. laws. Be sure to inspect the restrictions as well as regards to this protection before acquiring.

is a bit various. car insurance. Many individual car insurance policies and also charge card do not expand coverage to rentals you make in Europe, Central America and various other areas of the world. Nevertheless, some insurance provider and bank card will expand coverage for a restricted time to other countries for an added fee.

Make sure such prolonged insurance coverage meets the minimum requirements in the country or countries where you are traveling and has sufficient liability insurance coverage. See to it you recognize the limitations, exclusions and also limitations of insurance coverage. Traveling insurance policy for a trip abroad commonly has insurance coverage for a rental automobile. If you are purchasing traveling insurance, check for such protection and its restrictions and also terms.

If you pick this choice, acquisition it when you are making the bookings and examine the regards to the protection. Making the effort to understand as well as schedule adequate insurance policy protection for a rental cars and truck can provide you peace of mind as you navigate a restful vacation. cheaper car insurance. It can likewise save you moneydollars that might allow you to enjoy a few added deals with on holiday.

9 Simple Techniques For Should I Buy Rental Car Insurance? – 2022 Review – Aardy …

No, you don't require to have insurance since rental cars are currently guaranteed. That said, some kind of rental insurance policy is strongly advised due to the fact that if you rent an auto without insurance coverage, you are responsible for any damages to the automobile. Avis has a number of budget friendly vehicle service insurance options, or you can utilize another provider – accident.

Do I Have to Obtain Insurance Coverage Through Avis to Lease an Auto? You can choose to rent out a car without acquiring any type of securities or coverages through Avis. Just remember that while you are renting, you will certainly be accountable for anything that takes place to the car, such as a crash, criminal damage, tire damages, or a rollover (cars).

If you intend to depend on these forms of insurance policy throughout your rental period, Avis advises that you talk to your insurance provider or charge card company before you rent (money). To stay clear of obtaining stuck to damages fees, ensure you have some kind of insurance protection. Avis uses a number of excellent alternatives that you can request when making your appointment, when you get your leasing, or at any kind of time in between.

Does Avis Have Insurance Coverage on its Rental Cars and trucks? Avis provides obligation insurance coverage for all our vehicles as called for by regional regulations. In some states, the coverage offered by Avis is only used after the occupant's individual insurance policy has actually been utilized to cover all that it can. Talk to your insurer as well as with the Avis workplace where you lease your lorry to ensure you recognize exactly what will certainly be covered as well as what you may be accountable for in the event of an accident.

What Are My Rental Vehicle Insurance Policy Options? Yes, there are responsibility insurance coverage options offered through Avis for an added everyday charge.

The Basic Principles Of Insurance For Rental Car Damage: Where To Get It And Things …

Discover more concerning your Avis insurance coverage alternatives listed below. Loss Damage Waiver (LDW) A loss damage waiver lowers the amount you spend for any kind of damages to the auto. Your individual insurance policy may charge you an insurance deductible if your rental cars and truck obtains harmed, however with an LDW, you have no extra expenses.

No issue exactly how typically I cover the troubles that feature crash damage under automobile rental insurance coverage, consumers proceed to share their aggravations. A reader recently emailed me: "I have an interest in finding a total bumper-to-bumper, 'hand over the secrets at the counter' cars and truck rental coverage when I take a trip. I lately assumed I had complete protection though a credit report card, however when my auto experienced a small damage, the cars and truck rental firm flat-out refused to document that it in fact shed revenue from having the automobile leasing in the store (which took three weeks to fix a small dent) (insurance affordable).

Usually, a CDW begins at around $30 daily and can go higher. It sometimes costs a lot more than the base auto rental rate – insurance. The actuarial price to the rental companythe quantity it would designate toward a damages pool based upon danger experienceis possibly simply a couple of dollars a day; the rest is theirs to maintain.

Many non-CDW cars and truck service insurance policy will certainly cover those bonus. But, sometimes, protection relies on cooperation from the rental companyand it may not loom, as our viewers's above wasn't. In a lot of cases, if your routine automobile insurance covers accident damages to your insured car, it also covers damage to a temporary rental (cheaper auto insurance).

Yet insurance coverage on the majority of cards is additional, meaning the card grabs just what you can not initially recoup from your very own insurance policy. As well as you still need to pay the rental company up front, then file for repayment from your card provider. One more gotcha in the above small print: This card (as well as lots of others) pays for loss of use only if verified by the rental firm's log.

The Ins And Outs Of Rental Car Insurance – The General Fundamentals Explained

, for instance, offers coverage at around $9 per day – auto insurance. You do not acquire that from a car rental company: It usually comes with household, home owner, or tenant insurance policy, and it covers far even more than an auto leasing.